Once start date is entered, the end date should be automatically displayed in a two-week duration.Įnter your total income at the uppermost right corner of each biweekly table.

#Budget planner biweekly pay free

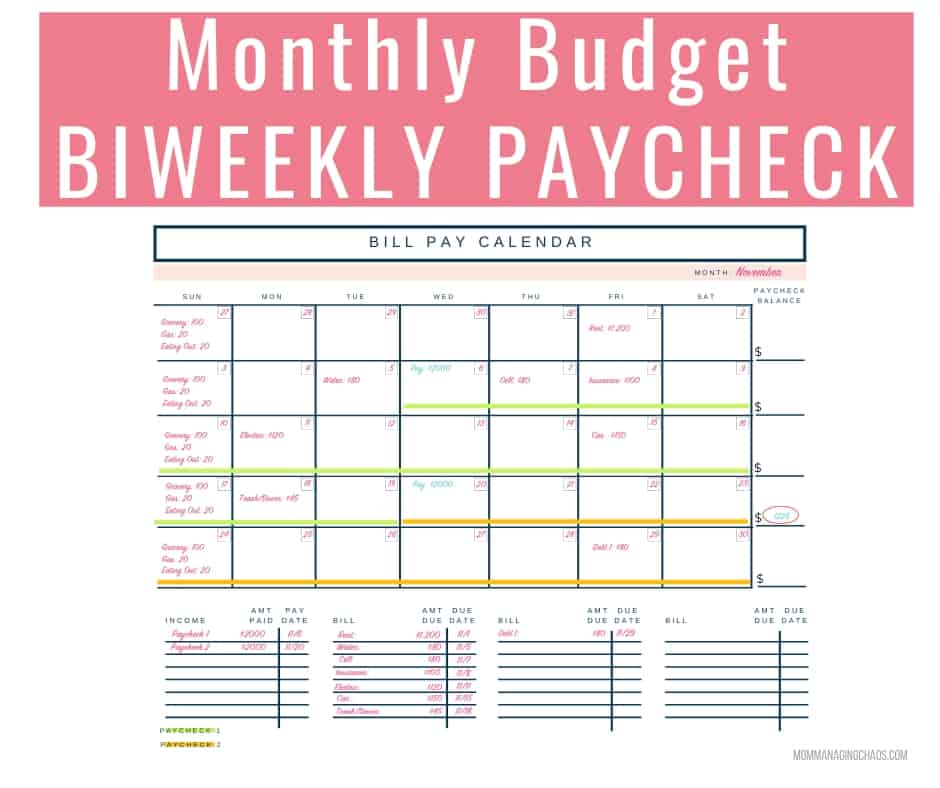

It's free to use, customize, edit, or download. A table for the monthly summary is also highlighted at the lowermost part to display your total monthly income, total monthly expenses, and total monthly balance.ĭownload this budget spreadsheet for a better management of your expenses. This family budget planner in Green design includes sections for the start date, end date, total income, total expenses, remaining balance, expenses, estimated budget, actual amount, and difference. To use the budget template, a step-by-step instruction is provided below. Each table shares the same features and functionality. It’s designed with two tables (Week #1 and Week #2) to cover your monthly expenses on a two-week duration. You don't need to manually calculate your expenses since this excel budget template features formulas therefore, calculations are autogenerated. variable expenses).This bi-weekly budget template is a helpful tool for tracking and managing your expenses on a two-week period. Now all that’s left is to allocate their discretionary income (i.e. They’ve done their bills and their sinking funds. In the picture below, this person has gone through and planned most of their month. Yes, the numbers will look very small, as it’s half of what you normally look at when doing a monthly budget. Then after your savings, is the spending categories that you came up with in step 4. Once you fill up your emergency fund, consider opening an IRA to help your retirement savings. Ideally, 10% of your savings should go into your emergency fund, with the leftover amount into your sinking funds (use cash envelopes or a savings account). If you haven’t saved much before, start with 5%, and then try and work up to saving 15% – 20%. Yes, you should absolutely be working a savings plan into your biweekly budget. You’ll need to take your first paycheck income minus your bills in the first two weeks and what’s leftover is for your saving & spending. If you’re prone to overspending, having a shorter timeline means you’ll be more aware of where you’re at financially because you have to check in with your money twice as often. I know that sounds a bit confusing, but think about it. You have less time to spend money without realizing you’ve overspent, which means you’ll spend less overall. This is why this budgeting method is easier to stick to. The key to success with bi-weekly budgeting is knowing exactly how much money you have to spend every two weeks. Step 5: Write out the first two weeks’ income & bills

This ensures that all our spending falls into the month that the money is budgeted.ĭon’t get too obsessed with this just get the closing dates as close as possible to match your planned budget. Because you can’t have them close on the 29th, 30th, or 31st as not all months have those dates. Since we get paid monthly, I have my credit cards close their billing cycle on the 1st of the month. Some companies let you choose from a few options, while others let you pick any due date. Some companies are flexible, and others are more rigid. You’ll want to call some of your bill companies and see if they can adjust your monthly bill cycle and/or bill due date. That’s making it so that most of your money is spent in the first half of the month, and then you have very little leftover for the rest of the month. So if in the first two weeks you have $800 in bills due, and in the second half of the month you have $200 due, then that’s bad. Take a look at your calendar, are all your bill due dates shoved up in one pay period? Now, it’s not necessarily the number of bills but the total amounts in each pay period. If your first paycheck in 2022 is Friday, January 14th, your three-paycheck months are July and December.”īut let’s focus on when you get paid twice a month, as that’s the most common. If your first paycheck in 2022 is scheduled for Friday, January 7th, your three-paycheck months will be April and September.

Step 3: Do you need to spread your monthly bills out? Call them.Įach month has two pay periods (usually), but there are two times a year when you get paid three times a month.Īccording to Grow, “The months in which you take home three checks depends on your pay schedule.

0 kommentar(er)

0 kommentar(er)